filter

-

Brand

- By Category

- Direction

- Date Range

307Events

Pictures

Events

Editorial Super Harvest Moon, Fort Worth, Texas, United States - 17 Sep 2024

- 2024-09-18

- 11

Editorial 'City of Dreams' Premiere Screening, Los Angeles, California, USA - 23 Aug 2024

- 2024-08-24

- 2

Editorial Shrimp Boat Beached, Port Aransas, Texas, United States - 11 Aug 2024

- 2024-08-12

- 2

Editorial Forest Fire, Edwards, Colorado, United States - 31 Jul 2024

- 2024-08-02

- 1

Editorial Colorado Wildfires 2024: Interlaken Fire, Edwards, United States - 31 Jul 2024

- 2024-08-01

- 11

Editorial Forest Fire, Edwards, Colorado, United States - 31 Jul 2024

- 2024-08-01

- 11

Editorial Independence Pass, Leadville, Colorado, United States - 26 Jul 2024

- 2024-07-27

- 1

Editorial St. Mary's Glacier, Idaho Springs, Colorado, United States - 24 Jul 2024

- 2024-07-25

- 8

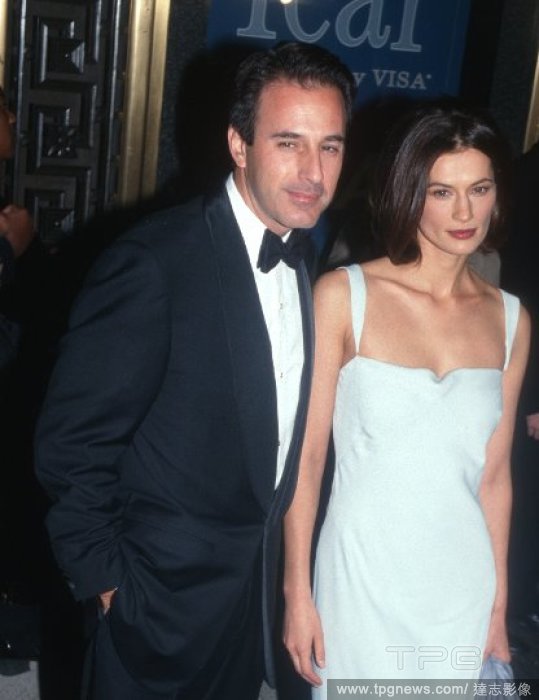

Editorial Matt Lauer Picking Up His Dry Cleaning

- 2024-07-23

- 1

Editorial EXCLUSIVE Matt Lauer rides his Vespa around The Hamptons

- 2024-07-11

- 9

Editorial Matt Lauer, Tamron Hall, Joy Behr, Ana Navarro. Clive Davis, Alec Baldwin and Hilaria Baldwin are seen leaving the Don Lemon and Tim Malone wedding

- 2024-04-07

- 29

Editorial Celebrities and guests attend Don Lemon and Tim Malone's wedding and reception in NYC!

- 2024-04-07

- 6

Editorial NHL: Nashville Predators at Winnipeg Jets

- 2024-03-14

- 1

Editorial NHL: Nashville Predators at Winnipeg Jets

- 2024-02-06

- 1

Editorial NHL: Philadelphia Flyers at Winnipeg Jets

- 2024-01-14

- 1

Editorial ENTER-MUS-CHICKS-LYNCH-SONGS-FT

- 2023-12-27

- 1

Editorial Laura Lynch 1958: 2023 American Musician

- 2023-12-24

- 1

Editorial ENTER-LYNCH-OBIT-FT

- 2023-12-24

- 1

Editorial ** PREMIUM EXCLUSIVE ** Amy Robach and T.J. Holmes bundle up for a chilly stroll in NYC after news of their exes dating.

- 2023-12-14

- 13

Editorial EXCLUSIVE: Amy Robach & TJ Holmes, Savanah Guthrie and her husband, Hoda Kotb, & Matt Lauer & Al Roker seen attending a wedding reception for former Today Show producer Jennifer Long & her husband Reid Sterrett in New York City

- 2023-12-10

- 14

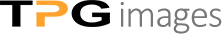

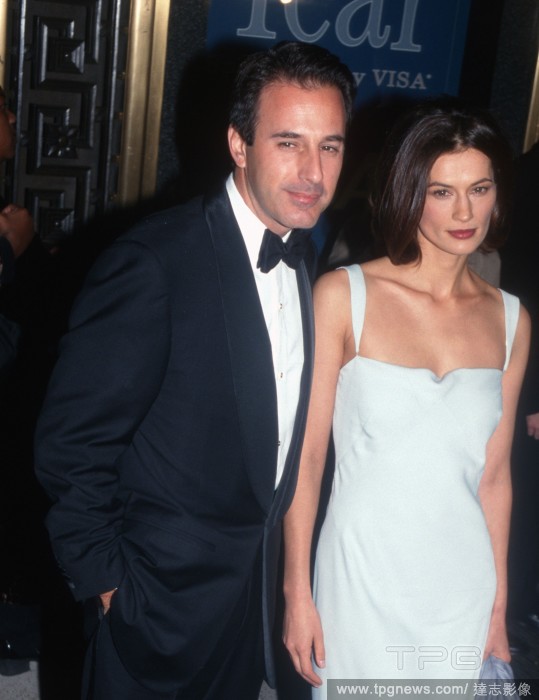

Editorial Matt Lauer Annette Roque Ex wife

- 2023-12-06

- 1

Editorial NHL: Dallas Stars at Winnipeg Jets

- 2023-11-29

- 1

Editorial MLB: Chicago Cubs at Milwaukee Brewers

- 2023-10-01

- 3

Editorial 'Melissa Etheridge - My Window' Opening Night on Broadway, New York, USA - 28 Sep 2023

- 2023-09-30

- 4

Editorial NY: The Southampton Animal Shelter Foundation Unconditional Love Gala at The Muses in Southampton, NY

- 2023-07-26

- 6

Editorial SAG-AFTRA - Rock The City For A Fair Contract, New York, USA - 25 Jul 2023

- 2023-07-26

- 2

Editorial NY: The Southampton Animal Shelter Foundation Unconditional Love Gala at The Muses in Southampton, NY

- 2023-07-23

- 10

Editorial NY: The Southampton Animal Shelter Foundation Unconditional Love Gala at The Muses in Southampton, NY

- 2023-06-28

- 1

Editorial NY: The Southampton Animal Shelter Foundation Unconditional Love Gala at The Muses in Southampton, NY

- 2023-06-15

- 1

Editorial NY: The Southampton Animal Shelter Foundation Unconditional Love Gala at The Muses in Southampton, NY

- 2023-06-15

- 1

Editorial NY: The Southampton Animal Shelter Foundation Unconditional Love Gala at The Muses in Southampton, NY

- 2023-06-14

- 1

Editorial NY: The Southampton Animal Shelter Foundation Unconditional Love Gala at The Muses in Southampton, NY

- 2023-06-07

- 1

Editorial NY: The Southampton Animal Shelter Foundation Unconditional Love Gala at The Muses in Southampton, NY

- 2023-05-23

- 9

Editorial NY: The Southampton Animal Shelter Foundation Unconditional Love Gala at The Muses in Southampton, NY

- 2023-05-22

- 3

Editorial NY: The Southampton Animal Shelter Foundation Unconditional Love Gala at The Muses in Southampton, NY

- 2023-05-16

- 7

Editorial NY: The Southampton Animal Shelter Foundation Unconditional Love Gala at The Muses in Southampton, NY

- 2023-05-11

- 5

Editorial NY: The Southampton Animal Shelter Foundation Unconditional Love Gala at The Muses in Southampton, NY

- 2023-05-04

- 4

Editorial NY: The Southampton Animal Shelter Foundation Unconditional Love Gala at The Muses in Southampton, NY

- 2023-05-01

- 1

Editorial NY: The Southampton Animal Shelter Foundation Unconditional Love Gala at The Muses in Southampton, NY

- 2023-04-26

- 3

Editorial NY: The Southampton Animal Shelter Foundation Unconditional Love Gala at The Muses in Southampton, NY

- 2023-04-20

- 3

Editorial NY: The Southampton Animal Shelter Foundation Unconditional Love Gala at The Muses in Southampton, NY

- 2023-04-15

- 3

Editorial The federal rule that requires funeral homes to list their prices didn’t envision the internet. Now, regulators are weighing an update that would require the homes to reveal their prices online. (Till Lauer/The New York Times)

- 2023-04-15

- 1

Editorial The federal rule that requires funeral homes to list their prices didn’t envision the internet. Now, regulators are weighing an update that would require the homes to reveal their prices online. (Till Lauer/The New York Times)

- 2023-04-14

- 1

Editorial The federal rule that requires funeral homes to list their prices didn’t envision the internet. Now, regulators are weighing an update that would require the homes to reveal their prices online. (Till Lauer/The New York Times)

- 2023-04-09

- 5

Editorial The average refund is down from last year, but still almost $3,000. One option experts recommend is stashing part of it for unexpected expenses. (Till Lauer/The New York Times)

- 2023-04-07

- 1

Editorial The average refund is down from last year, but still almost $3,000. One option experts recommend is stashing part of it for unexpected expenses. (Till Lauer/The New York Times)

- 2023-04-03

- 2

Editorial The average refund is down from last year, but still almost $3,000. One option experts recommend is stashing part of it for unexpected expenses. (Till Lauer/The New York Times)

- 2023-03-28

- 1

Editorial The average refund is down from last year, but still almost $3,000. One option experts recommend is stashing part of it for unexpected expenses. (Till Lauer/The New York Times)

- 2023-03-17

- 3

Editorial MLB: Spring Training-Milwaukee Brewers Photo Day

- 2023-02-23

- 1

Editorial While they have taken steps to help prevent mishaps, a new report finds mobile payment apps offer few protections if, for instance, users accidentally send money to the wrong person. (Till Lauer/The New York Times)

- 2023-01-28

- 1

Editorial Only those who became disabled by age 26 have been eligible for ABLE accounts. But Congress raised the age to 46, so more military veterans and others can qualify as of 2026. (Till Lauer/The New York Times)

- 2023-01-21

- 1

Editorial With the expiration of more generous tax credits offered as pandemic relief, many taxpayers could see “significantly smaller” refunds this year, the Internal Revenue Service says. (Till Lauer/The New York Times)

- 2023-01-14

- 1

Editorial The Game Awards 2022, Arrivals, Los Angeles, California, USA - 08 Dec 2022

- 2022-12-10

- 2

Editorial The Game Awards, Arrivals, Los Angeles, California, USA - 08 Dec 2022

- 2022-12-09

- 1

Editorial CA: The Game Awards 2022 - Arrivals

- 2022-12-09

- 2

Editorial Credit card balances have been rising rapidly. But there are ways to navigate the gift-giving season without taking on a lot of new debt. (Till Lauer/The New York Times)

- 2022-11-26

- 1

Editorial The cost of heating a home is expected to spike this winter, as higher prices for natural gas and heating oil combine with a forecast for slightly colder weather than last winter. (Till Lauer/The New York Times)

- 2022-11-12

- 1

Editorial Premiums for job-based health insurance may rise next year, though employers may not pass on the full increase for fear of alienating their workers, analysts say. (Till Lauer/The New York Times)

- 2022-11-05

- 1

Editorial A growing number of states are pushing high school seniors to file the federal financial aid form because evidence suggests that students who complete the form are more likely to attend college. (Till Lauer/The New York Times)

- 2022-10-15

- 1

Editorial A growing number of American workers are getting access to a new job benefit: help with saving for unexpected expenses. Such rainy-day funds may help attract employees. (Till Lauer/The New York Times)

- 2022-10-08

- 1

Editorial MLB: Arizona Diamondbacks at Milwaukee Brewers

- 2022-10-05

- 5

Editorial A law requires online marketplaces to send out a Form 1099-K for sales of $600 or more. Most casual sellers will not owe taxes on the sales, but that’s not always clear. (Till Lauer/The New York Times)

- 2022-10-01

- 1

Editorial MLB: Miami Marlins at Milwaukee Brewers

- 2022-09-30

- 2

Editorial MLB: Milwaukee Brewers at Cincinnati Reds

- 2022-09-24

- 1

Editorial The government adjusts its tax code every year, including the standard deduction and tax brackets. Rising costs mean big changes next year. (Till Lauer/The New York Times)

- 2022-09-24

- 1

Editorial Relaxed rules during the pandemic let workers carry over more of the pretax money, which must be spent on health costs or forfeited, but they’re expiring. (Till Lauer/The New York Times)

- 2022-09-17

- 1

Editorial About 1.6 million taxpayers who missed deadlines for filing their 2019 and 2020 federal income tax returns will get automatic refunds of late-filing penalties under a new pandemic relief program — if they file by Sept. 30, 2022. (Till Lauer/The New York Times)

- 2022-09-09

- 2

Editorial MLB: Milwaukee Brewers at Arizona Diamondbacks

- 2022-09-05

- 1

Editorial The student loan debt cancellation program is already providing grist for scammers, consumer advocates say. (Till Lauer/The New York Times)

- 2022-09-02

- 1

Editorial MLB: Chicago Cubs at Milwaukee Brewers

- 2022-08-30

- 2

Editorial Orion Crew and Service Modules at the Kennedy Space Center, Florida, United States - 28 Aug 2022

- 2022-08-30

- 2

Editorial Orion Crew and Service Modules at the Kennedy Space Center

- 2022-08-29

- 2

Editorial As the stock and bond markets have wobbled, 529 plans have taken a tumble. There’s no one-size-fits-all answer, but you have options. (Till Lauer/The New York Times)

- 2022-08-26

- 1

Editorial MLB: Milwaukee Brewers at Los Angeles Dodgers

- 2022-08-23

- 4

Editorial MLB: Los Angeles Dodgers at Milwaukee Brewers

- 2022-08-18

- 2

Editorial MLB: Milwaukee Brewers at St. Louis Cardinals

- 2022-08-13

- 3

Editorial MLB: Cincinnati Reds at Milwaukee Brewers

- 2022-08-06

- 3

Editorial A renter's insurance for students can help pay for property damaged in a fire or stolen; and replacing clothes, furniture and electronic gadgets adds up. (Till Lauer/The New York Times)

- 2022-08-06

- 1

Loading

Loading