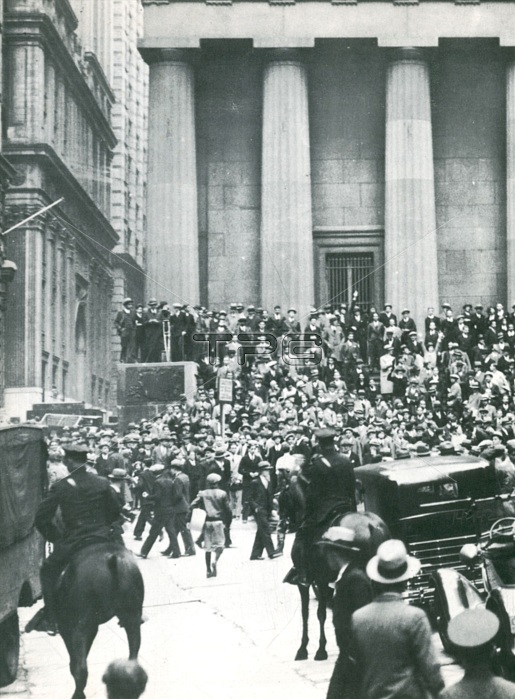

The Wall Street Crash of 1929 was the most devastating stock market crash in the history of the United States, taking into consideration the full extent and duration of its fallout. The crash signaled the beginning of the 12-year Great Depression that affected all Western industrialized countries and that did not end in the United States until the onset of American mobilization for World War II at the end of 1941. On October 24 (Black Thursday), the market lost 11% of its value at the opening bell on very heavy trading. Several leading Wall Street bankers met to find a solution to the panic and chaos on the trading floor.[8] The meeting included Thomas W. Lamont, acting head of Morgan Bank; Albert Wiggin, head of the Chase National Bank; and Charles E. Mitchell, president of the National City Bank of New York. They chose Richard Whitney, vice president of the Exchange, to act on their behalf. With the bankers' financial resources behind him, Whitney placed a bid to purchase a large block of shares in U.S. Steel at a price well above the current market. As traders watched, Whitney then placed similar bids on other "blue chip" stocks. This tactic was similar to one that ended the Panic of 1907. It succeeded in halting the slide. The Dow Jones Industrial Average recovered, closing with it down only 6.38 points for the day; however, unlike 1907, the respite was only temporary.

| px | px | dpi | = | cm | x | cm | = | MB |

Details

Creative#:

TOP22158638

Source:

達志影像

Authorization Type:

RM

Release Information:

須由TPG 完整授權

Model Release:

No

Property Release:

No

Right to Privacy:

No

Same folder images:

Loading

Loading